The Four Fits: Why Building a Great SaaS Product Isn’t Enough

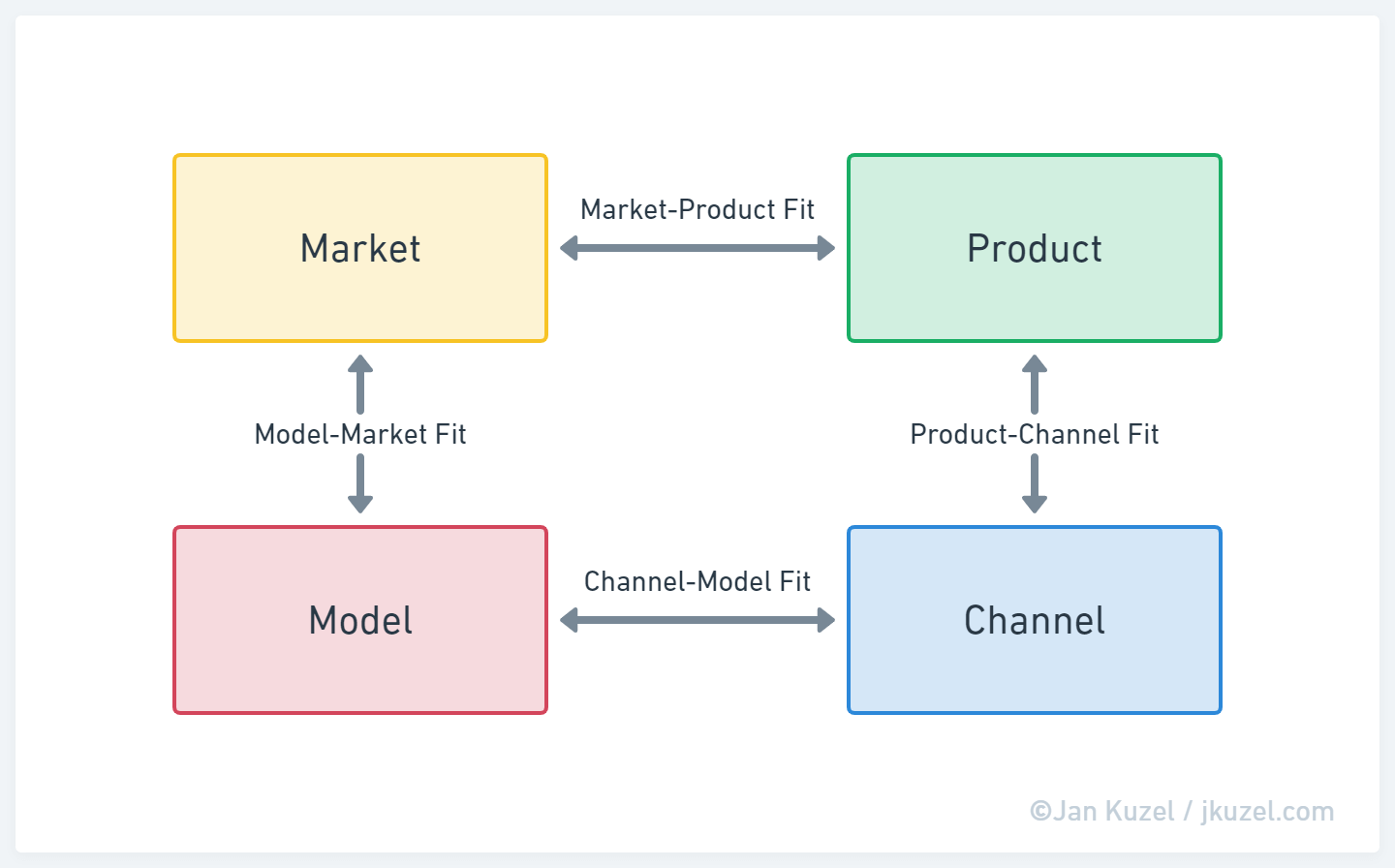

Enter the Four Fits

In 2017, Brian Balfour (Former VP of Growth at HubSpot, Founder of Reforge) penned an enlightening series of articles beginning with Why Product Market Fit Isn't Enough. Balfour aimed to emphasize that having a great product or even achieving Product-Market Fit, is no longer the complete recipe for success. He introduced the concept of The Four Fits, asserting that victory hinges on harmonizing these crucial elements.

Pushing a Boulder Uphill

How does achieving the Four Fits look in real terms?

Picture this: a company that seems like a disorderly mess—marketing misses the mark, the product is riddled with bugs and suffers from poor UX, and the customer support leaves much to be desired. Despite all these, they enjoy significant growth. Growth is akin to rolling a boulder downhill—almost effortless.

Then imagine another company that seems to have all its ducks in a row—excellent support, bug-free software, a product designed to perfection, and more. However, their growth pace is excruciatingly slow. Here, achieving growth feels like pushing that boulder uphill—a real struggle.

Have you seen this before? I certainly have, and so has Brian Balfour.

Try spearheading a marketing campaign or navigating a sales call for either of these companies; you'll notice a stark difference in how difficult it is to achieve any results.

Balfour identified that the key factor separating these disparate companies was their mastery (or lack thereof) of the Four Fits.

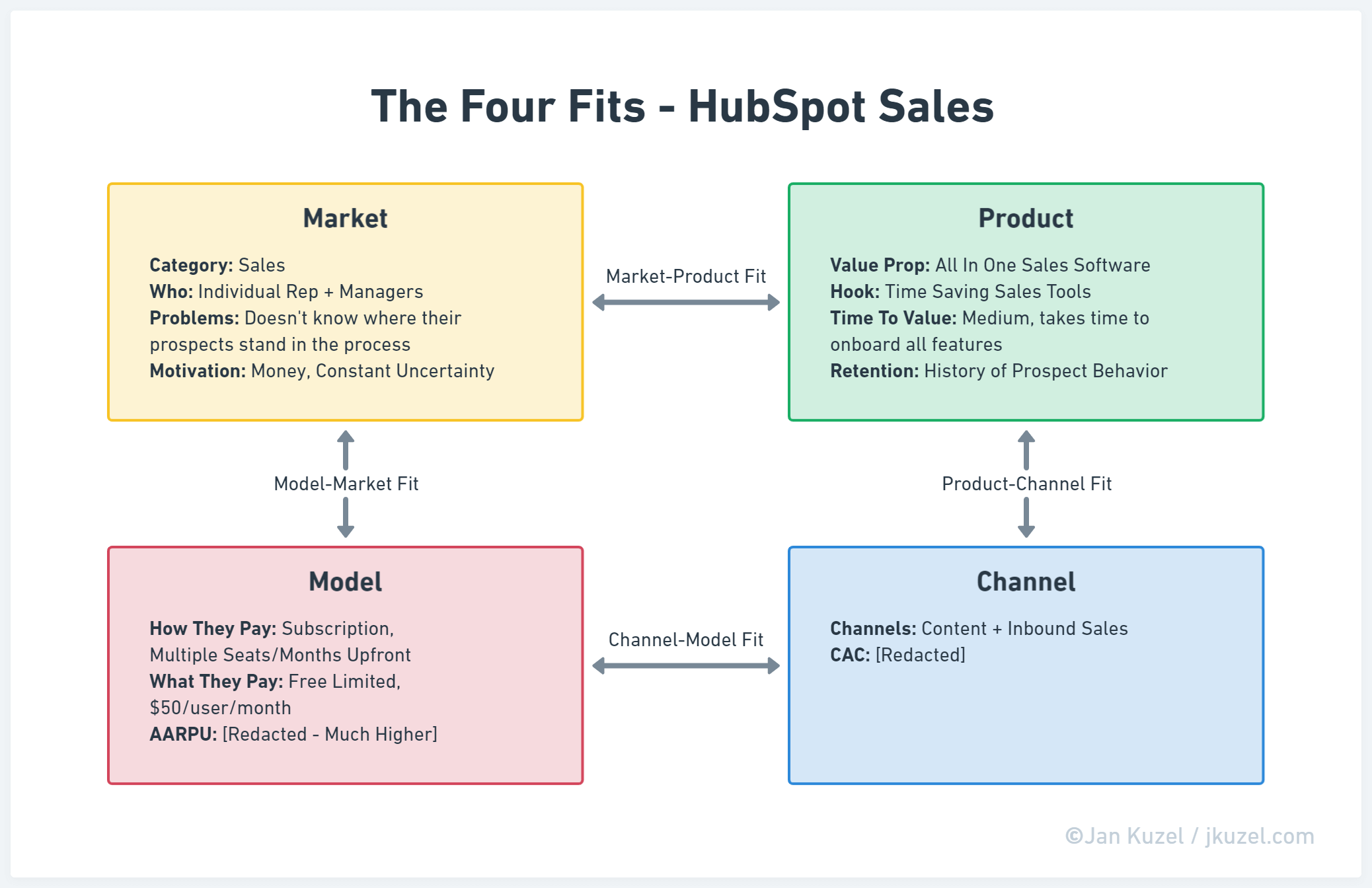

Unpacking the Four Fits

The Four Fits are a bit similar to The Positioning framework, but they are more extensive with details of channels used, the pricing model chosen, and the compatibility of all these. The best explanation is provided in the video case study that unpacks the Four Fits through the lens of HubSpot's success story.

In today's highly evolved and cutthroat marketplace, Brian’s insights carry immense weight. Imagine it as a high-stakes game where the rules have become more complex and the players more cunning. A superficial strategy just won't cut it anymore. Of course, there may be smaller, more insular markets where you can play by the old rules, but if you're stepping into the big leagues of global competitive markets, mastering the Four Fits is your key to survival—and domination.

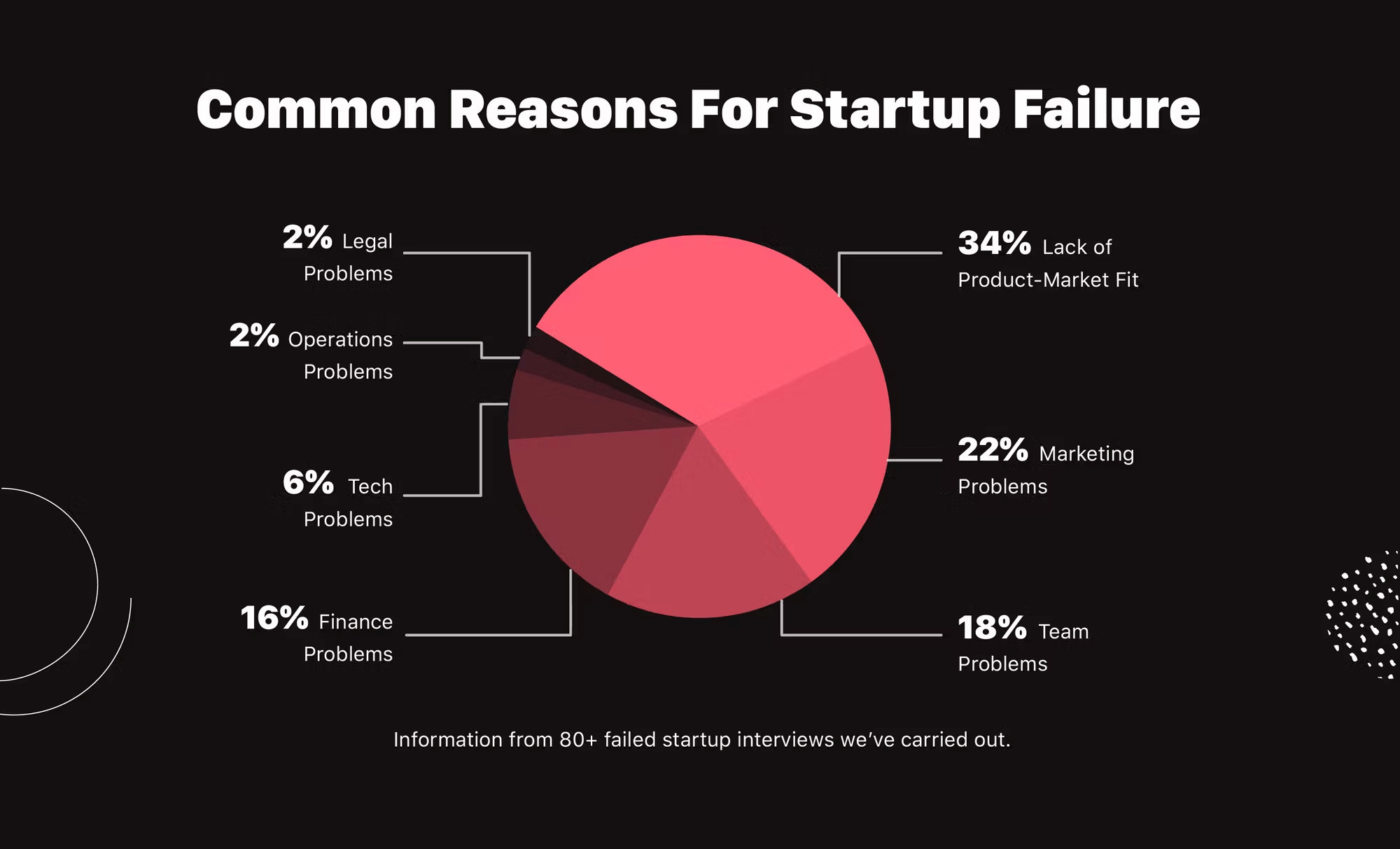

Causes of Startup Failures

So, is there concrete evidence supporting the importance of nailing the Four Fits or creating an outstanding product? The 2019 CB Insights report presents a compelling case. It points to "No Market Need", “Getting outcompeted”, “Flawed business model”, and “Pricing issues” as the primary culprits behind startup collapses. All of these pitfalls can be traced back to a poor grasp of the Four Fits.

This notion is further reinforced by the Failory survey in 2021, which identifies the leading causes of failure as building the wrong type of product and failing to market it. The once lauded mantra of “Build a great product and they will come” has faded in our increasingly competitive and rapidly evolving markets. Although the quality of technology will always play some role, it is no longer a remotely important factor for success.

Importance of Strategy

The Four Fits are about the company's marketing strategy, which heavily relies on the skillset of a strategic Marketing, Growth, or, in the best case, Product Marketing person.

This leads us to the realization that having a good strategy is the most important factor for achieving success. If you are unable to develop it on your own, hiring the right person to create it for you becomes one of the most critical tasks you will ever face as a company founder.

In reality, few lucky companies may stumble upon the right balance of the Four Fits by chance even without thinking about it much. However, without a strategic focus, growth may eventually stagnate. If they lack a strategic person to help them understand what's going on, they will struggle.

Doing It Right First Time

The right strategy can save time, resources, and potentially the company from competitor encroachment. It's not just about moving in the right direction—it's about moving there fast.

In a perfect world, unlimited resources would allow endless trial and error until nailing the Four Fits. But we live in a reality, where resources are finite. Founders should, therefore, focus on identifying the right initial path to prevent costly detours later on.

Marketing Is Not a Product

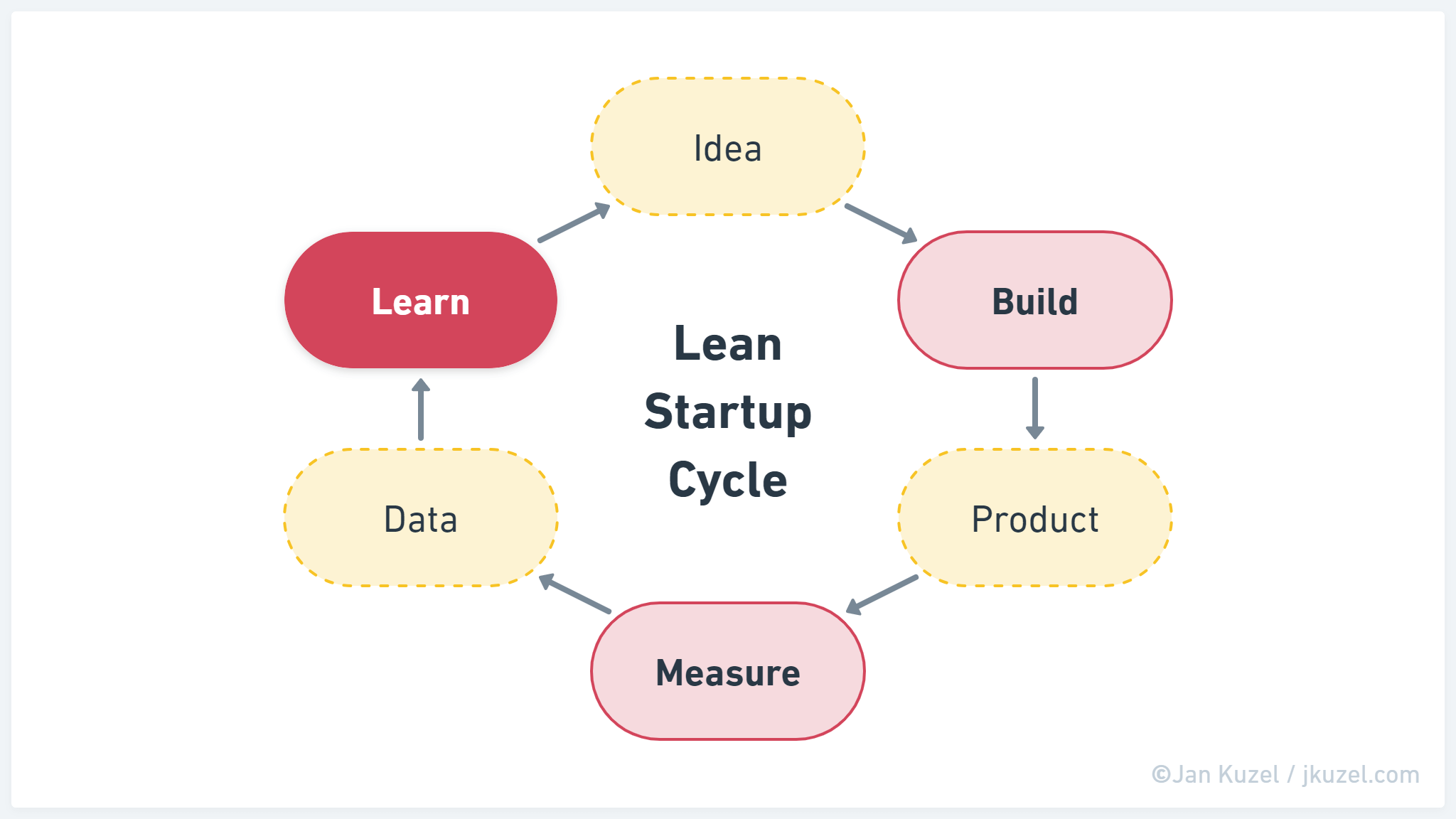

The Lean Startup methodology champions quick experimentation cycles. However, the rush of rapid building can lead to overlooking the crucial 'Learn' phase. Instead of blindly throwing darts, sometimes it's necessary to pause, take aim, and then throw.

More importantly, remember that Lean methodology applies to product development, not marketing. If you for example choose content/SEO as your acquisition channel, expect to spend a year and a significant budget to start seeing any results at all.

Such a decision is neither cheap nor fast. Many founders treat marketing as a product and try to do just that, they start a bunch of tactics without fully developing them, thinking they are “experimenting”. In reality, they are wasting resources for weak or no results at all.

What You Should Do

Securing success in the SaaS space goes beyond merely creating a strong product or devising creative marketing campaigns—it's fundamentally rooted in robust strategic clarity.

To achieve strategic clarity, you need to conduct various types of structured customer and prospect interviews, run surveys, build and analyze analytics data, research the market, conduct competitor and pricing analysis, and refine your business model, positioning, and messaging.

Every effort to fully understand your customer needs and the market environment chips away at uncertainty, establishing strategic clarity and enabling the right calibration for the Four Fits. It's about aligning your offering, your market, and your future customers in functional harmony.

If you need help refining your marketing strategy, consider working with me.

Free Templates